It seems that one of the most allusive states mankind seeks is this thing we have dubbed Financial Freedom.

Up until maybe a decade ago, we weren’t so concerned about winning the money game so quickly. We worked, saved our money, did our best to invest it wisely and then when that day came around, we quit working and enjoyed the rest of our days.

Now it seems everyone is rushing around the world trying to win the money game as quickly as possible. Some accomplish this goal, but most end up working for a living for a very long time.

Regardless of how quickly you want to, or do, win the money game, here is the simple answer to the question the participants in our financial education programs ask all of the time.

That question is… “How do I win the money game?”

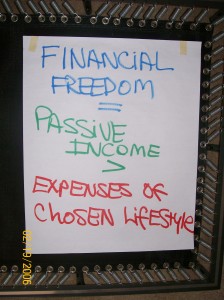

Passive Income from Assets – Your Expenses = Financial Freedom Score

Simply put, you are financially free when the passive income from your assets is greater than the expenses of your chosen lifestyle. Robert Kiyasaki made this definition popular in his best selling book, Rich Dad Poor Dad.

In other words, if your current lifestyle requires $5000 per month, you are financially free when you no longer have to work for that $5000. It is coming in month after month passively.

OK…so it’s not completely passive…most of us have to put in a few hours a day or week to make sure our real estate investments, our stocks, bonds, and mutual funds, our commodities investments (gold, silver, platinum, oil, etc.) and our businesses are doing well and are well-managed.

But the thing is, you’re not trading your time and energy for money anymore. You’re not dependent on that thing we call ‘a job.’

When we teach our Camp Millionaire events or a Money Game Day, we show our participants how to win the money game on a flipchart that looks like this…

So there you have it, how to win the money game. Now that you know the definition, you have to actually get to work to create it for yourself.

Learning to win the money game

As I said above, that seems to be the allusive part. Why? There are a few reasons why human beings don’t achieve financial freedom in their lives:

- We’re not conditioned or taught to strive for financial freedom as children. We’re conditioned to get a job and trade our time and energy for money for decades.

- We’re programmed for ‘retirement’ (or retardment as the funny little story about retirement from a child’s perspective goes). The term retirement has always meant that time when a person stops working. Most successful financially free people today still work…they just aren’t trading their time and energy for money anymore.

- Our parents didn’t know enough about money and investing to teach us.

- We didn’t have parents who were home enough to teach us…they might have been busy working on their own retirement and forgot to teach us.

- We don’t learn about money and investing in school.

It would seem that the most logical solution would be to implement an in-depth financial education program in all our schools. But NOT just for one semester or one term.

There are several studies that have reported that ‘financial education doesn’t work.’ But neither would math or science or English if the kids only had it for one semester!

Consider for a second, that our success in life and living comfortably doesn’t have a whole lot to do with what grade we got in math or science or English? It DOES have a heck of a lot to do with what we learned about money and how well we were able to take it forward and use it in adulthood.

Financial literacy education needs to start in 1st grade with learning what physical money is. Learning to count it and learn what it buys and having competitions with the kids to see how much they can save during a school year.

It needs to continue in grade school with kids learning what it takes to run a household (and no, they aren’t too young…if they can add, they can figure it out).

In 5th-7th grade kids need to explore the idea of making their own money. Being little entrepreneurs at a very early age instills financial self-esteem into a child that lasts forever!

As they go into high school, it’s time to begin to explore investing, i.e., making their money grow. Saving contests should continue (teens are very competitive), they need to do more budgeting on what it takes to live as a college student or high school graduate (i.e., adult) and begin to explore the active side of investing: real estate, stocks, business, commodities.

Let’s consider teaching kids math THROUGH money instead of the other way around.

Let’s teach kids reading through learning about companies by reading through prospectuses.

Let’s teach them about writing by having them learn how to write business plans, great copywriting and giving them great marketing skills.

In other words, let’s ask ourselves, “What does it take for an adult to be truly successful in life?” and then let’s teach them THAT in school.

Now we’re talking education.

The best way to teach children how to win the money game is by having them play it early and often. Have kids play as many financial education games as you can find. Financial board games, interactive money games, online money games…there are more and more popping up all the time. Just do a search for ‘money game’ or ‘financial education game’ or even ‘personal finance game’ and you’ll be amazed at what comes up.

So, if you’re a parent, let’s get them taught about money.

If you’re a teacher or youth group leader, check our The Money Game and find out how easy is really is to teach kids how to win the money game.

If you’re an adult who hasn’t learned what it takes to win the money game, it’s OK. You’re not alone. But now that you know, it’s time for you to learn, too.

But please, regardless how you go about winning the money game for yourself? Have a great time along the way!

Click here for more information or if you’re ready to

order your copy of The Money Game!

Leave A Comment